The Homebuyer's Playbook

Thinking about buying a home? This detailed Homebuyer's Playbook is the resource you have been looking for.

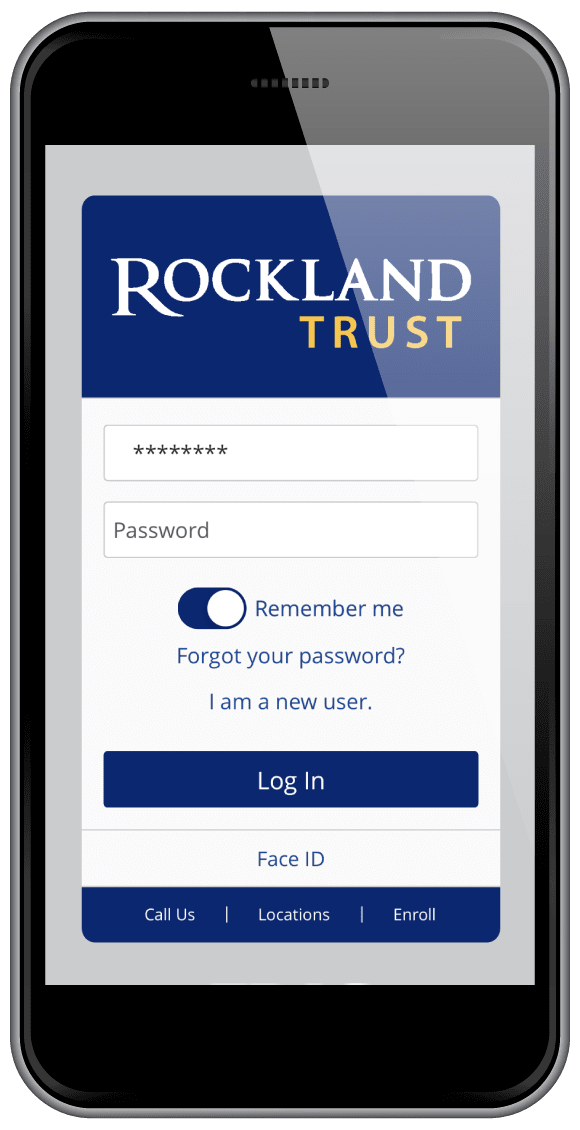

We know your time is valuable. That's why we make it as easy as possible to take care of your financial business online and with your mobile device.